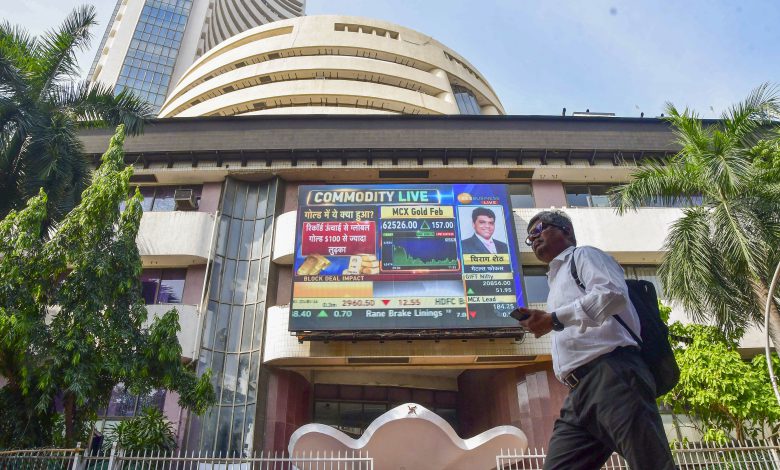

Indian equity indices, BSE Sensex and Nifty50, showed a strong recovery in early trading on Tuesday following a sharp decline the previous day. By 9:40 AM, the BSE Sensex had climbed to 74,163.30, marking a gain of 1,025 points or 1.40%, while the Nifty50 stood at 22,472.05, up by 310 points or 1.40%.

The recent market downturn was primarily driven by global disruptions stemming from retaliatory trade tariffs. Analysts suggest that this year’s record lows have prompted investors to adopt a cautious approach amid heightened volatility.

Dr. V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, commented on the situation: “The ongoing uncertainty in global markets is likely to persist for some time. Key observations include the trade war being largely confined to the US and China, while other regions like the EU and Japan are pursuing negotiations. India has also initiated talks for a bilateral trade agreement with the US. Additionally, the risk of a US recession has grown, and China appears to be the most vulnerable economy due to potential tariff hikes by President Trump.”

He further noted that long-term investors might consider high-quality large-cap stocks, particularly in financials and pharmaceuticals, given India’s stable macroeconomic conditions and fair valuations.

The market capitalization of NSE-listed companies has dropped by $280 billion over three trading sessions following the US tariff announcement. On Monday alone, foreign institutional investors sold Indian equities worth $1.05 billion—the largest single-day outflow since February.

Shiv Chanani, Equity Fund Manager at Baroda BNP Paribas Mutual Fund, told Reuters that investor sentiment remains dominated by fear and uncertainty until global trade stabilizes. However, he acknowledged that Indian equities could see a rebound.

US markets displayed mixed trends on Monday amid concerns over economic slowdown and inflation. President Trump reiterated his stance on tariffs, hinting at further duties on Chinese imports.

Also read: Trump Warns China of 104% Tariff Amid Military Spending Concerns

Asian markets opened higher on Tuesday after recovering from earlier losses triggered by fears surrounding US trade policies. Gold prices also rose after hitting a four-week low in the previous session as investors sought safe-haven assets amid escalating trade tensions. Similarly, oil prices rebounded over 1% after recent losses but remained under pressure due to concerns about reduced global demand.

Foreign portfolio investors recorded net sales of ₹9,040 crore on Monday, while domestic institutional investors purchased shares worth ₹12,122 crore.