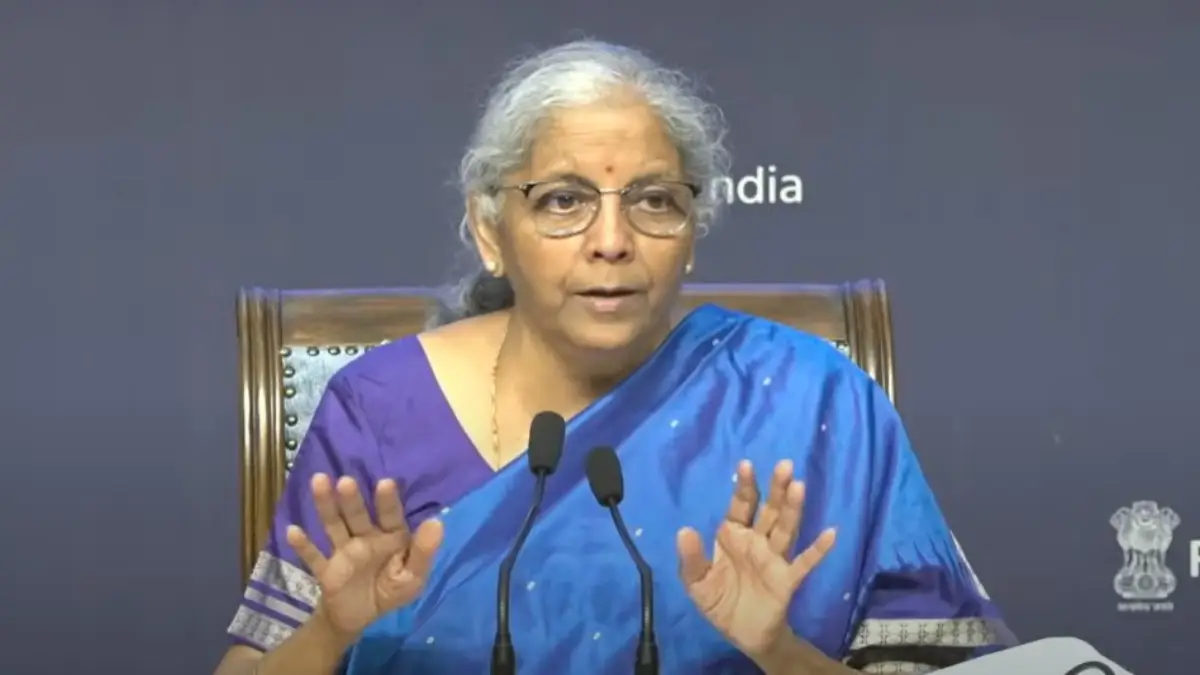

Finance Minister Nirmala Sitharaman on Wednesday unveiled the most significant overhaul of the Goods and Services Tax (GST) framework since its introduction in 2017, announcing the rollout of a simplified two-slab structure under what is being termed “GST 2.0.” The reform reduces rates on a wide range of essentials, medicines, consumer products, and automobiles, while creating a new top slab for luxury and sin goods.

“These reforms have been brought in with consensus. There will be two main slabs, and the issue of compensation cess is being addressed. Rate rationalisation was a unanimous agenda before the Council,” Sitharaman said after the GST Council meeting.

Cheaper Essentials for Households

Daily-use products are among the biggest beneficiaries of the changes. Items like hair oil, soaps, shampoos, toothbrushes, and bicycles will now fall under the 5% GST slab, reduced from 18%.

Food products including milk, paneer, and Indian breads have been made completely GST-exempt, down from a 5% levy. Packaged snacks and staples such as namkeen, bhujiya, sauces, pasta, cornflakes, butter, and ghee will now be taxed at just 5%, lowering kitchen and grocery bills.

Healthcare expenses have also been eased, with 33 life-saving medicines dropped from 12% to zero tax. Corrective spectacles and lenses will now attract only 5% GST instead of 28%, offering relief to households on medical spends.

Relief for Automobiles and Housing

The construction and automobile sectors are expected to benefit from the new regime. Cement, a key building material, will now be taxed at 18% instead of 28%.

On the mobility side, motorcycles below 350cc, three-wheelers, and small cars have all shifted into the 18% bracket, down from 28%. Larger passenger vehicles, including buses, trucks, and ambulances, also move to the same slab. Auto components, previously spread across various tax rates, will now be uniformly taxed at 18%.

New 40% “Sin and Luxury” Tax Slab

While most goods have become cheaper, a special 40% slab has been created for products classified as luxury or harmful consumption. This includes cigarettes, gutkha, paan masala, sugary aerated drinks, caffeinated beverages, fruit-based carbonated drinks, and other such items.

High-end personal transport such as big cars, motorcycles above 350cc, yachts, and private jets will also fall under this new 40% bracket, keeping luxury purchases heavily taxed.

Handicrafts, marble and granite blocks, intermediate leather products, and natural menthol will see their duties fall to 5%, down from 12%.

A Leaner, Consumer-Friendly GST Regime

The revamped framework effectively moves India toward just two key GST slabs — 5% and 18%, apart from the special 40% bracket for luxury and sin goods.

Economists argue the reforms could help ease inflation, boost consumer demand, and provide fresh momentum to sectors such as FMCG, autos, and housing. However, they warn that the Centre and states must carefully track revenue implications, as extensive tax cuts could strain fiscal balances unless offset by cess collections or improved compliance.

For now, GST 2.0 is being pitched as a lean, simplified, and consumer-friendly tax system — bringing relief to households and industries alike, while ensuring luxury consumption continues to be taxed at a premium.