Boatman’s Family Made Rs 30 Crore, How Maha Kumbh Mela 2025 Turned This Boatman Family’s Fortunes Around

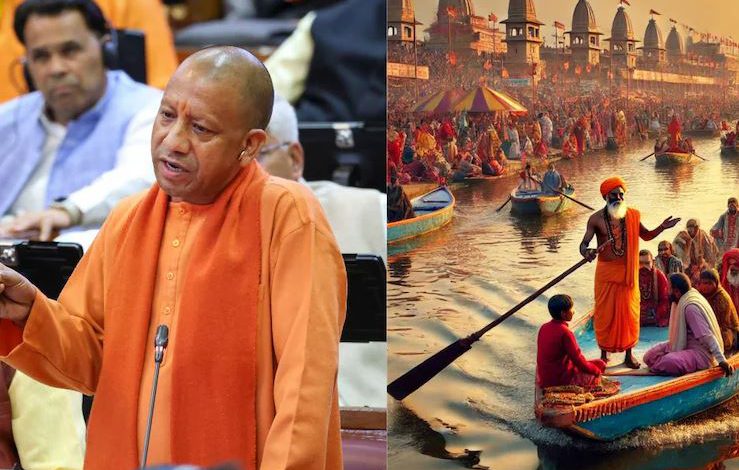

UP Chief Minister Yogi Adityanath highlighted the massive economic activity generated during the Maha Kumbh in Prayagraj, asserting a ₹3 lakh crore boost across various sectors. In order to substantiate his claims of the massive economic success of Maha Kumbh, CM Yogi narrated the story of a boatman’s family that made huge returns in just 45 days.

A Family operating 130 boats reportedly made Rs 30 crore in profit over 45 days, with each boat earning between ₹50,000 and ₹52,000 daily. CM Adityanath stated I am telling the success story of a boatman’s family. They have 130 boats. In 45 days (of Maha Kumbh), they have profited ₹30 crore… This means each boat has earned Rs 23 lakh. On a daily basis, they earned ₹50,000-52,000 from each boat. The event saw over 66 crore visitors without any reported crime incidents, a point of pride for CM Adityanath.

He said that not a single case of harassment, kidnapping, robbery, or murder was reported. 66 crore people arrived, participated and left happily. Those who couldn’t attend felt they missed out, but those who did were left in awe. The government invested Rs 7,500 crore in the event, with revenues impacting the hotel, food, and transportation sectors significantly. Infrastructure enhancements were a key focus, with the construction of over 200 widened roads, 14 flyovers, and a modern airport terminal.

CM Adityanath informed the assembly, with these developments expected to contribute to India’s projected 6.5% GDP growth. Through Maha Kumbh, we provided infrastructure that will benefit the city for decades. Over 200 roads were widened, 14 flyovers, nine underpasses, and 12 corridors were constructed.

Former Infosys CFO Mohandas Pai dismissed a social media user’s claims on the earnings from the recently concluded Maha Kumbh Mela 2025. Pai dismissed the user’s claim about Maha Kumbh as “silly,” stating that much of the event’s spending is not subject to GST. He pointed out that expenses such as food, necessities, boat trips, local purchases, unregistered small businesses, and fuel are taxed at the state level, not under GST.

Input tax in GST refers to the tax paid on purchases of goods and services that can be claimed back by businesses as a credit against their output tax liability. The user questioned the disparity in expected versus actual GST collections, stating, “What happened to rest ₹44,845 crores GST collection?”