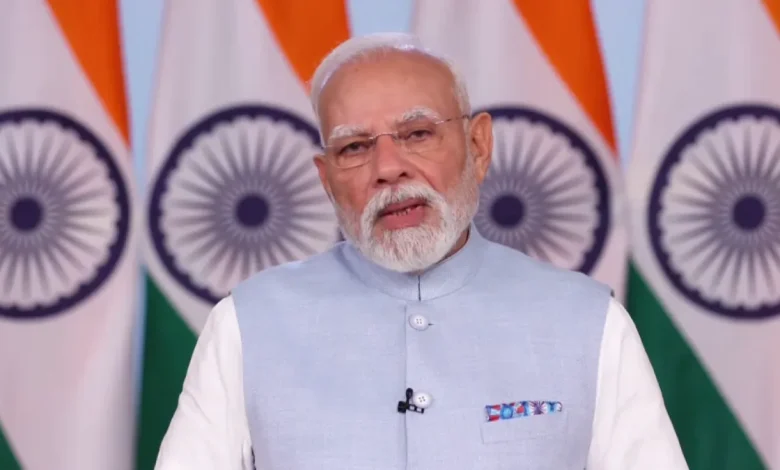

NEW DELHI, September 21, 2025: Prime Minister Narendra Modi addressed the nation on Sunday, heralding the upcoming implementation of the ‘NextGen GST reforms’ as a national ‘Bachat Utsav’ (Festival of Savings) set to commence on Monday, September 22. The Prime Minister asserted that the overhauled tax regime will enhance household savings and accelerate India’s economic growth.

In his address, PM Modi reflected on the historical significance of the Goods and Services Tax, noting that its initial implementation in 2017 marked a pivotal break from a complex past. He detailed the pre-GST era where businesses and citizens were burdened by a tangled web of numerous taxes.

“For decades, our country’s people and our traders were entangled in a web of various taxes. Octroi, entry tax, sales tax, excise, VAT, service tax dozens of such taxes existed. To send goods from one city to another, we had to cross countless checkpoints,” the Prime Minister stated.

The new framework, approved by the GST Council earlier this month under the leadership of Union Finance Minister Nirmala Sitharaman, simplifies the existing structure. The council’s decision, announced on September 3, involved the elimination of the 12% and 28% tax slabs.

The reformed system will primarily operate on two main tax rates. Additionally, a special slab of 40% will be applied to specific luxury items and so-called ‘sin goods’. This higher rate will cover products such as tobacco, pan masala, cigarettes, bidis, aerated sugary beverages, luxury vehicles, high-capacity motorcycles, yachts, and helicopters.

The government anticipates that the streamlined tax structure will bring tangible financial relief to families and further strengthen India’s economic trajectory.