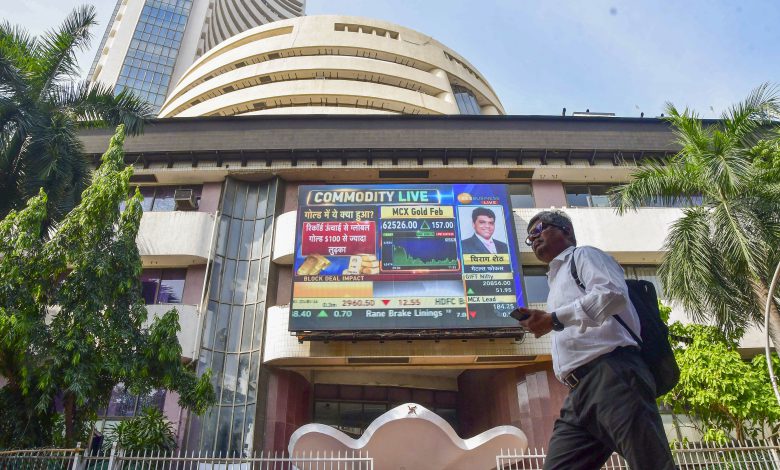

Mumbai (PTI): The benchmark BSE Sensex continued its downward trend for the fourth consecutive day on Wednesday, falling 72 points to close at 74,029.76 after touching a low of 73,598.16. Similarly, the NSE Nifty dropped 27.40 points to finish at 22,470.50, hitting an intraday low of 22,329.55.

Concerns over US economic growth have particularly affected IT stocks. Major companies like Infosys, Tech Mahindra, Nestle India, Tata Consultancy Services, HCL Technologies, Asian Paints, Axis Bank, Zomato, Hindustan Unilever, and Bharti Airtel struggled, while stocks such as IndusInd Bank, Tata Motors, Kotak Mahindra Bank, Bajaj Finance, HDFC Bank, ITC, Sun Pharma, Bajaj Finserv, and UltraTech Cement managed to record gains.

The BSE Smallcap index fell by 0.48 percent, and the midcap index slipped 0.57 percent. Vinod Nair, Head of Research at Geojit Financial Services, attributed the market’s subdued performance to persistent global trade uncertainties and fears of a US recession. Despite some stabilization in valuation levels and improving demand across urban and rural sectors, investor caution remains high amid worries that corrections in the US market could spill over globally.

Across various sectoral indices, IT, Teck, Realty, Telecommunication, Metal, Capital Goods, Services, and Industrial sectors were among the worst performers. In contrast, sectors such as Energy, FMCG, financial services, Healthcare, Utilities, Auto, Bankex, Consumer Durables, Oil & Gas, and Power showed modest gains.

IT stocks fell more than 5 percent as anxiety grew over the potential impact of a recession in the US. In related news, shares of Bharti Airtel and Reliance Industries ended on mixed notes after both companies announced their partnerships with Elon Musk’s SpaceX to provide high-speed internet services in India.

Overall, 2,491 stocks declined on the BSE, while 1,494 advanced and 137 remained unchanged, leading to a drop in the market capitalization of BSE-listed firms by Rs 1,40,922.64 crore to Rs 3,92,84,618.08 crore (approximately USD 4.50 trillion).

After market close, official data showed that retail inflation eased to 3.61 percent in February, mainly due to slower price increases for vegetables and protein-rich items. This decline from January’s 4.26 percent and February 2024’s 5.09 percent may provide the Reserve Bank of India with room to consider a second interest rate cut next month. The year-on-year inflation rate for February 2025 was recorded at 3.75 percent by the National Statistics Office.

In international markets, Tokyo, Seoul, Shanghai, and Hong Kong ended the day mixed, while European stocks were trading higher in mid-session deals on Wednesday. Meanwhile, Wall Street closed in negative territory on Tuesday, and global benchmark Brent crude oil prices edged up 0.34 percent to USD 69.80 a barrel.

Data from Tuesday also revealed that Foreign Institutional Investors (FIIs) sold equities worth Rs 2,823.76 crore, whereas Domestic Institutional Investors (DIIs) purchased equities valued at Rs 2,001.79 crore. On the previous day, the 30-share BSE Sensex fell by 12.85 points to 74,102.32, while the NSE Nifty advanced by 37.60 points to 22,497.90.

(With PTI Inputs)