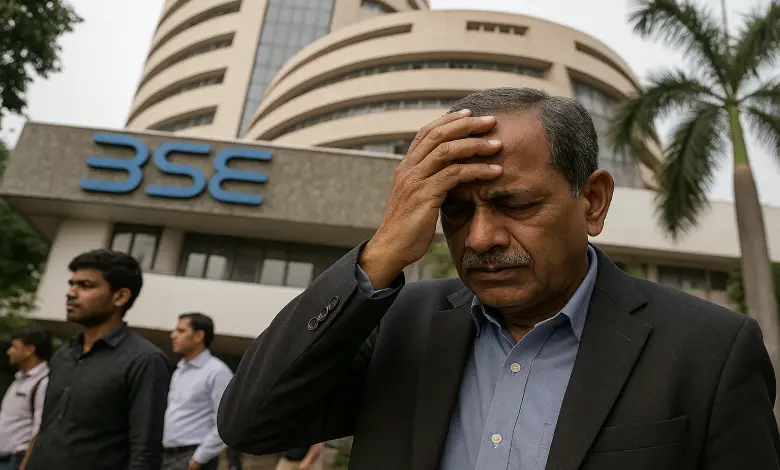

New Delhi: Investor wealth took a massive hit on Monday as the Indian stock market faced a sharp downturn, mirroring global market turbulence fueled by escalating trade war fears. The BSE Sensex nosedived 3,939.68 points (5.22%) to 71,425.01 in early trading, erasing ₹20.16 lakh crore from the market capitalization of BSE-listed companies, which now stands at ₹383.18 lakh crore.

All 30 Sensex constituents traded in the red, with Tata Steel and Tata Motors plunging over 10% each. Other major decliners included Larsen & Toubro, HCL Technologies, Adani Ports, and Reliance Industries. The broader BSE smallcap and midcap indices also suffered, falling 6.62% and 5.01%, respectively.

Sectoral indices were deeply negative, with metals leading the losses at nearly 8%. Industrials, IT, consumer discretionary, and commodities sectors followed suit with declines ranging from 4.84% to 6.39%.

Also read: Asian markets, oil prices Plummet as Wall Street bleeds over Trump’s tariffs

The sell-off was not limited to India; Asian markets also recorded steep losses. Hong Kong’s Hang Seng index plummeted over 11%, while Japan’s Nikkei 225 and South Korea’s Kospi dropped 7% and 5%, respectively. U.S. markets had closed significantly lower on Friday, with the S&P 500 falling by 5.97%, Nasdaq by 5.82%, and Dow Jones by 5.50%.

Also read: Global Markets Reel as “Black Monday” Triggers Steep Declines

Market experts attribute the volatility to uncertainty surrounding U.S. tariffs imposed by President Donald Trump. “The markets are grappling with extreme uncertainty due to Trump’s tariffs,” said V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services. He advised investors to adopt a “wait-and-watch” approach during this turbulent phase.

Adding to the economic jitters, global oil benchmark Brent crude fell by 2.76% to $63.77 per barrel.