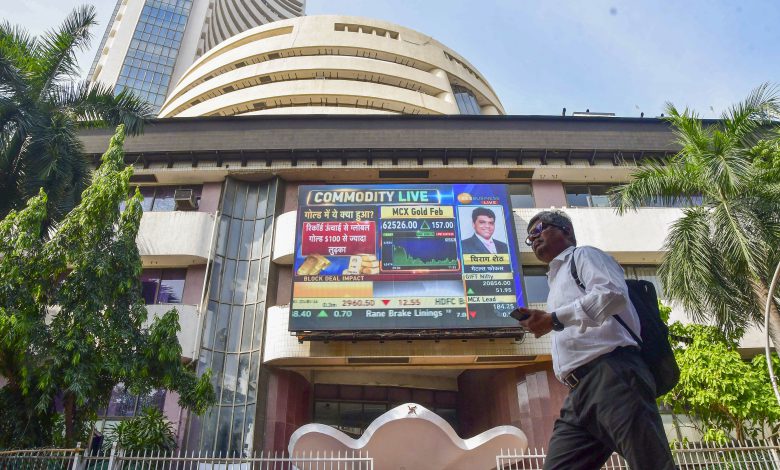

Mumbai: Indian equity markets stumbled in early trading on Tuesday, with the Sensex sliding 639 points to 76,775 and the Nifty dipping 180 points to 23,339. A sharp sell-off in IT stocks, fueled by jitters over President Donald Trump’s looming reciprocal tariffs, drove the decline.

Major Sensex losers included Infosys, Tata Consultancy Services, Bajaj Finance, HDFC Bank, Axis Bank, Bajaj Finserv, HCL Tech, and Maruti. On the flip side, IndusInd Bank surged nearly 5%, joined by Power Grid, Bharti Airtel, Mahindra & Mahindra, Adani Ports, Nestle, and NTPC, all posting gains.

Asian peers—Seoul, Tokyo, Shanghai, and Hong Kong—traded higher, while US markets closed mostly up on Monday. All eyes are now on Trump, who is set to unveil his “Liberation Day” tariff plan on April 2, a move he claims will bolster the US economy.

VK Vijayakumar, Chief Investment Strategist at Geojit Investments Limited, noted, “Global markets are laser-focused on Trump’s tariff details, due tomorrow. The fallout will shape trends based on how these measures hit various nations and industries.”

India enjoyed a strong March, delivering a 6.3% return and outshining most global markets, per Vijayakumar. He credited Foreign Institutional Investors (FIIs) turning buyers and subsequent short covering for the upswing, adding, “Whether this rally holds or reverses depends largely on Trump’s tariff reveal.”

Exchange data showed FIIs offloaded Rs 4,352.82 crore in equities on Friday. Markets were shuttered Monday for Eid-Ul-Fitr. Meanwhile, Brent crude, the global oil benchmark, rose 1.51% to USD 74.74 a barrel.

Last week wrapped up with the Sensex at 77,414.92, down 191.51 points or 0.25%, and the Nifty at 23,519.35, off 72.60 points or 0.31%.