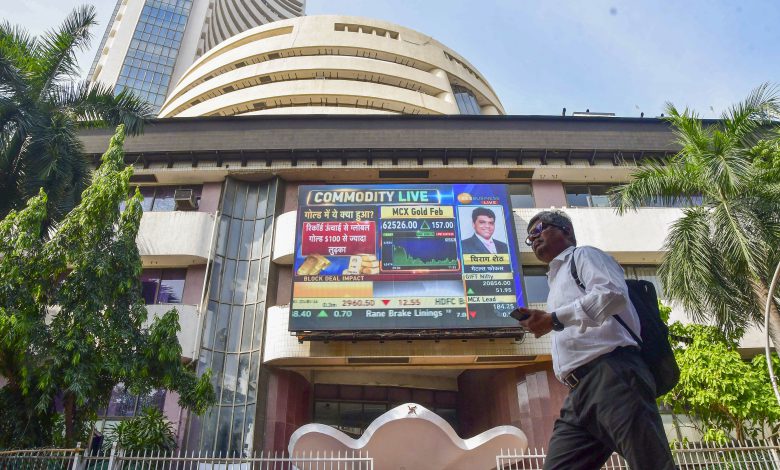

Mumbai: India’s benchmark stock market indices began Friday’s trading session in the red, primarily due to a dip in information technology (IT) sector stocks. As of 9:25 am, the S&P BSE Sensex was at 81,587.44, down by 45.58 points, while the NSE Nifty50 recorded a gain of 24.20 points, reaching 24,857.80.

Dr. V.K. Vijayakumar, Chief Investment Strategist at Geojit Investments Limited, noted that consistent institutional investment flows, from both Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs), are stabilizing the market even without significant positive catalysts.

He anticipates the current consolidation phase to continue in the short term. Vijayakumar highlighted two key trends influencing the markets: “One, India’s macros are strong and improving. Two, this positive trend in macros is not getting reflected in corporate earnings. This is the fundamental reason for the range bound movement of the market.”

Among the top performers on the Sensex, Larsen & Toubro led the way, climbing 0.88% at the opening bell. Adani Ports and Special Economic Zone also gained 0.88%, followed by Nestle India with a 0.87% advance. Sun Pharmaceutical Industries and Bajaj Finserv rounded out the top five gainers, rising 0.56% and 0.54%, respectively.

Conversely, Infosys experienced a decline, dropping 1.78% in early trading. Tech Mahindra also faced pressure, falling 1.16%, while HCL Technologies retreated by 0.73%. IndusInd Bank slipped 0.52%, and Mahindra & Mahindra saw a decline of 0.26%.

The Nifty Midcap100 saw an increase of 0.30%, while the Nifty Smallcap100 posted a smaller gain of 0.19%. The India VIX, a volatility index, sharply dropped by 8.86%.

Among the sectoral indices, Nifty Realty led the gains with a 0.29% rise, followed by Nifty Media climbing 0.25%. Nifty PSU Bank advanced 0.16%, Nifty Pharma gained 0.09%, Nifty Private Bank was up 0.08%, Nifty Auto rose 0.03%, and Nifty Financial Services posted a marginal gain of 0.02%.

However, some sectors opened in negative territory. Nifty IT faced the steepest decline of 0.29%, while Nifty Consumer Durables slipped 0.12%, and Nifty FMCG dropped marginally by 0.04%.

Vijayakumar further commented on earnings growth: “FY25 Nifty earnings growth was a pedestrian 5.5% and the projection for FY26 is around 10%. Valuation multiple of 21 for 10% earnings growth is certainly on the higher side. This will cap the upside to the Nifty until leading indicators suggest a recovery in earnings growth.”

He concluded by advising investors to “remain invested and buy quality stocks on dips,” citing continuously improving macroeconomic indicators such as resilient GDP growth, declining inflation and interest rates, and shrinking fiscal and current account deficits, which he believes will lay the groundwork for a robust economy and earnings recovery in the medium term.

(Disclaimer: Views expressed by analysts or brokerages are their own. Always consult a financial advisor before making investment decisions.)