Business

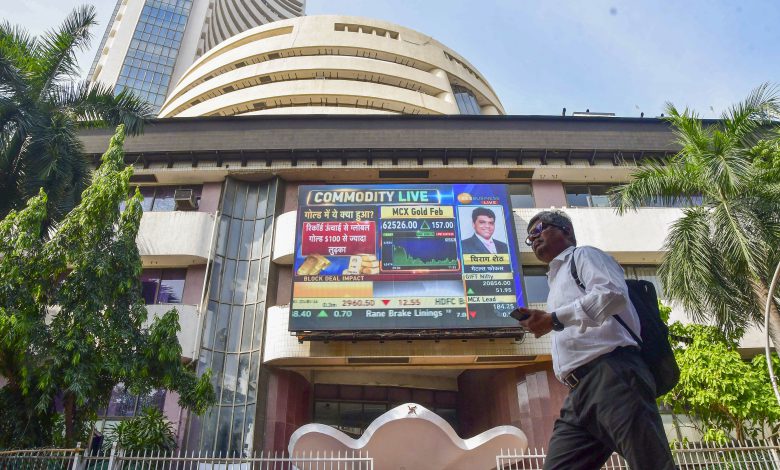

Sensex, Nifty Hold Steady; BEL & Reliance Outperform — 10 Key Market Takeaways Today

The Indian stock market saw modest gains on Tuesday, July 1, with the Sensex and Nifty 50 closing slightly higher, driven by strong performances from Bharat Electronics (BEL), Reliance Industries, and HDFC Bank, despite mixed signals from global markets.The Sensex rose 91 points, or 0.11%, to close at 83,697.29, while the Nifty 50 gained 25 points, or 0.10%, ending at 25,541.80. However, mid and small-cap indices underperformed, with the BSE Midcap index down 0.07% and the Smallcap index slipping 0.18%.

Indian Stock Market: 10 Highlights from Today

- What Drove the Market?

The benchmark indices eked out gains, supported by heavyweights like Reliance Industries, HDFC Bank, and BEL. However, losses in stocks such as ICICI Bank, Axis Bank, and TCS capped the upside. Investor caution persisted amid uncertainty surrounding India-US trade talks, with both sides hinting at progress but offering little clarity. Weak global cues, tied to an upcoming vote on US President Donald Trump’s tax bill, also weighed on sentiment.

Technically, the Nifty 50 is hovering near the upper Bollinger band, signaling upward momentum. Praveen Dwarakanath, Vice President of Hedged.in, noted that the index has support at 25,200 and resistance at 25,900. He added, “Momentum indicators on smaller timeframes are trending higher, suggesting potential for further gains. The Keltner channel’s upper band at 25,430 could act as a key level for any pullback.” - Top Nifty 50 Gainers

Apollo Hospitals Enterprise led with a 3.63% surge, followed by BEL (up 2.70%) and Reliance Industries (up 1.75%). - Top Nifty 50 Losers

Nestle India fell 2.22%, Axis Bank dropped 2.14%, and Shriram Finance declined 1.53%. Of the Nifty 50 stocks, 26 closed in the red. - Sectoral Performance

The Nifty Bank index gained 0.26%, and the PSU Bank index rose 0.71%, while the Private Bank index inched up 0.12%. The Nifty Media index was the biggest loser, down 1.31%, followed by Nifty FMCG (down 0.69%) and Nifty IT (down 0.30%). - Most Active Stocks by Volume

Vodafone Idea topped trading volumes with 66.81 crore shares, followed by RattanIndia Power (23.27 crore shares) and Filatex Fashions (20.65 crore shares) on the NSE. - Stocks Surging Over 10%

Nine stocks, including Gabriel India, Tamilnadu Telecommunication, Dangee Dums, Zota Health Care, and Century Extrusions, rallied more than 10% on the NSE. - Upper and Lower Circuits

A total of 119 stocks, such as Indef Manufacturing, Gabriel India, Iris Business Services, Dolphin Offshore Enterprises, and Zodiac Energy, hit their upper circuit limits during intraday trading on the NSE. Conversely, 43 stocks, including Mayasheel Ventures, Eppeltone Engineers, and Nirman Agri Genetics, hit their lower circuits. - Advance-Decline Ratio

The market leaned toward gainers, with 2,021 stocks advancing and 1,989 declining out of 4,164 traded on the BSE. Another 154 stocks remained unchanged. - 52-Week Highs and Lows

As many as 168 stocks, including BEL, InterGlobe Aviation (IndiGo), Apollo Hospitals Enterprise, AU Small Finance Bank, Divis Laboratories, Federal Bank, and Max Healthcare Institute, touched their 52-week highs on the BSE. Meanwhile, 46 stocks, such as Salasar Techno Engineering, ArisInfra Solutions, and Raw Edge Industrial Solutions, hit their 52-week lows. - Nifty’s Technical Outlook

Analysts see 25,600 as a critical resistance level for the Nifty 50. A sustained breakout could drive the index toward 25,700–25,750, according to Shrikant Chouhan, head of equity research at Kotak Securities. He noted that the market’s current trend is non-directional. “For bulls, 25,600 is the key level to watch. A breakout could spark a rally to 25,700–25,750, but a drop below 25,470 might trigger selling, pulling the index to 25,375–25,300,” Chouhan said.

Disclaimer: This article is for informational purposes only. The views and recommendations are those of individual analysts or brokerage firms, not Mumbai Samachar. Investors are advised to consult certified experts before making investment decisions, as market conditions can shift rapidly, and individual circumstances may vary.