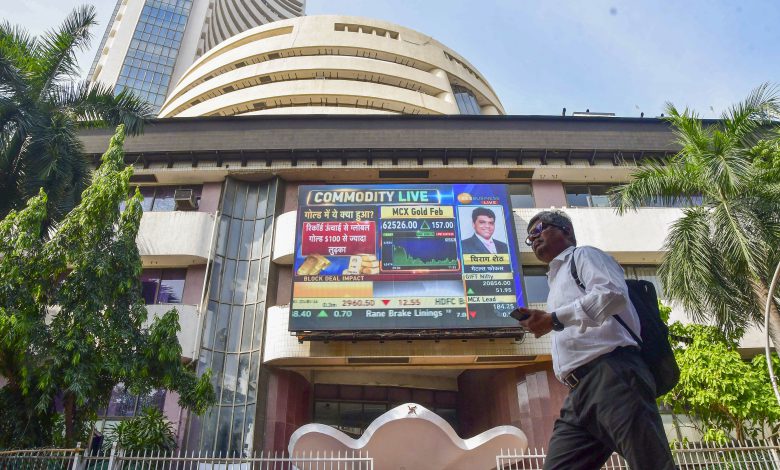

Indian stock markets are set for a positive opening on Friday, driven by a 90-day pause on US tariffs that has lifted investor confidence. Despite ongoing uncertainties in global trade, the temporary relief has provided a short-term boost to market sentiment.

Trading was closed on Thursday in India for Mahavir Jayanti. In the previous session, domestic indices had ended lower even as the Reserve Bank of India (RBI) announced a 25-basis-point repo rate cut, reducing it to 6%.

Early indicators point to a strong start. As of 8:20 am, Gift Nifty futures were trading at 22,933.5, up 2.5% from the Nifty 50’s closing level of 22,399.15 on Wednesday—suggesting a likely upswing in Indian equities.

Justin Khoo, Senior Market Analyst for APAC at VT Markets, noted that the Indian markets may open robustly on April 11. He attributed the surge in GIFT Nifty—up nearly 743 points or 3.3%—to the relief sparked by the US tariff pause. This could benefit sectors hit hardest by trade concerns in recent weeks.

Khoo added that India’s prospects could improve further if it secures favorable trade agreements with the US in the coming weeks, aiding the Nifty’s recovery.

Stocks to Watch:

A few key stocks are expected to attract attention in Friday’s session, especially after developments in global markets.

Wall Street rallied sharply on Wednesday following US President Donald Trump’s announcement of a temporary halt on certain tariffs. However, new duties on Chinese imports tempered the optimism, sparking a short-lived global rally.

By Thursday night, US indices had turned lower amid renewed concerns that the ongoing trade war could weigh heavily on the global economy. Investors sought safer assets like gold, which hit a record high. Meanwhile, crude oil prices initially rose post-announcement but fell later due to weak demand and escalating trade tensions.

While the US move has eased market pressure in the short term, analysts warned that sudden policy shifts are adding to global volatility, complicating investment strategies.

India, meanwhile, is ramping up its trade negotiations with the US. A government source confirmed that talks are progressing rapidly with the goal of concluding a trade pact soon.

Volatility on the Rise:

Market turbulence is a growing concern. The Nifty Volatility Index (NIFVIX) surged 55.8% this week to 21.43—the steepest weekly rise since March 2020—indicating heightened expectations of sharp market swings.

Among major corporate updates, Tata Consultancy Services (TCS) will be under focus after posting weaker-than-expected fourth-quarter earnings. The IT giant cited US tariff-related uncertainty as a factor causing delays in client projects and spending cutbacks.

Given that a significant portion of India’s IT sector revenue comes from the US, continued unpredictability in trade relations is putting pressure on tech stocks.

Additionally, foreign institutional investors (FIIs) have continued to withdraw from Indian equities. Wednesday marked the eighth consecutive session of net outflows, bringing the total FII sell-off in 2025 to $16.6 billion—further straining the market.