The US military action aimed at dismantling President Nicolás Maduro’s Venezuelan regime presents a paradoxical situation for India—a largely neutral effect on equity markets but a potentially lucrative billion-dollar opportunity for state-owned oil companies.

The geopolitical shift strengthens a “weaker oil price” outlook that may support US disinflation efforts and benefit emerging market assets over time, according to Ankita Pathak, Head of Global Investments at Ionic Asset by Angel One.

Oil sector windfall

Venezuela’s regime transition centers less on broad economic implications and more on tangible financial gains, with ONGC Videsh Ltd. positioned as the principal beneficiary. A US-orchestrated restructuring of Petróleos de Venezuela SA could release approximately $1 billion in outstanding payments to ONGC Videsh, PTI reports.

ONGC Videsh holds a 40% interest in the San Cristobal field but hasn’t been able to bring back roughly $536 million in dividends accumulated through 2014, plus a comparable sum for later years. Field production has plummeted to between 5,000 and 10,000 barrels daily following US sanctions imposed in 2020.

As US restrictions are expected to relax, ONGC Videsh plans to deploy drilling equipment from its Gujarat operations to restore output to the 80,000–100,000 barrels per day level, officials indicated. “A US-led takeover (of Venezuela) could deliver a direct benefit to India, potentially unlocking close to $1 billion in long-pending dues,” analysts told PTI, noting that Oil India Ltd. and Indian Oil Corp. Ltd. might also realize value from their minority holdings in the Carabobo-1 venture.

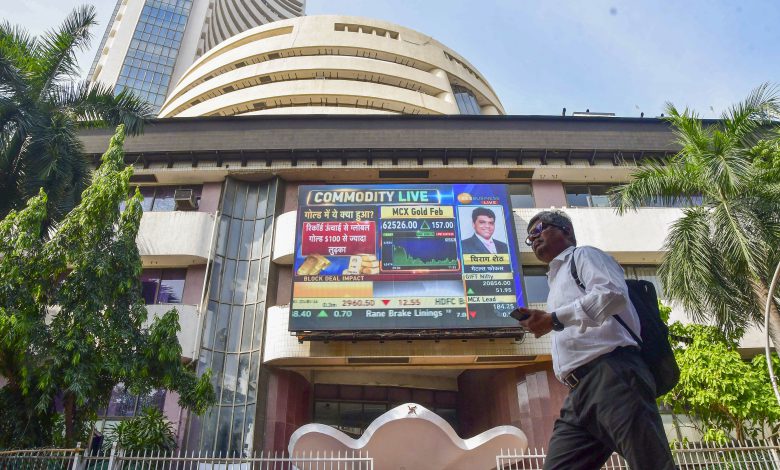

Stock market implications

The impact on India’s equity markets hinges largely on crude oil price movements. Pathak suggests that while immediate supply interruptions may trigger occasional price jumps, the “longer-term bias remains negative as supply dynamics improve”.

“Over the medium to long term, weaker oil prices could ease US inflation pressures, potentially enabling further rate cuts and a weaker dollar—supportive for emerging markets,” Pathak wrote.

For Indian equities specifically, the effect “remains largely neutral beyond indirect effects from oil price movements”.

Assets potentially affected

ONGC: Possible recovery of $1 billion in dividends and enhanced production at San Cristobal, per PTI.

Gold: Protection against short-term geopolitical tensions.

Reliance Industries: Possible margin improvements from diversified crude procurement, according to Kpler.

Refining strategy shift

Venezuela’s oil return could reshape India’s refining approach. Since the Ukraine conflict, India has depended significantly on discounted Russian crude. Restored access to Venezuela’s heavy, sour crude—which Indian refineries possess the sophisticated capacity to handle presents a diversification avenue.

“If sanctions are eased… Venezuelan crude could offer additional flexibility to Indian refiners and help ease supply concentration risks,” stated Nikhil Dubey, senior research analyst at Kpler. “That would reduce India’s reliance on Russian oil imports, a key bottleneck in ongoing India-US trade discussions”.

GTRI data shows India’s crude purchases from Venezuela dropped 81.3% to merely $255.3 million in FY25, while exports dominated by pharmaceutical products totaled a modest $95.3 million. “Given the low trade volumes…the current developments in Venezuela are not expected to have any meaningful impact on India’s economy,” GTRI stated, cautioning that India must carefully navigate “wars for raw materials” to safeguard its strategic independence.

Investment strategy

As Latin America stabilizes, investment experts recommend measured caution combined with selective opportunities. Pathak from Ionic Asset emphasizes that “precious metals, especially gold, are likely to remain well supported amid heightened geopolitical uncertainty”.

Read More:

While short-term turbulence is probable as markets process the diplomatic consequences, eliminating Venezuela’s political uncertainty represents a “constructive” development for the medium term. “Volatility may offer selective opportunities in geographies and sectors less exposed to oil prices,” she concluded.