Bharat Coking Coal IPO: Grey Market Premium Rebounds to ₹11, Issue Subscribed Over 52 Times – Should You Apply?

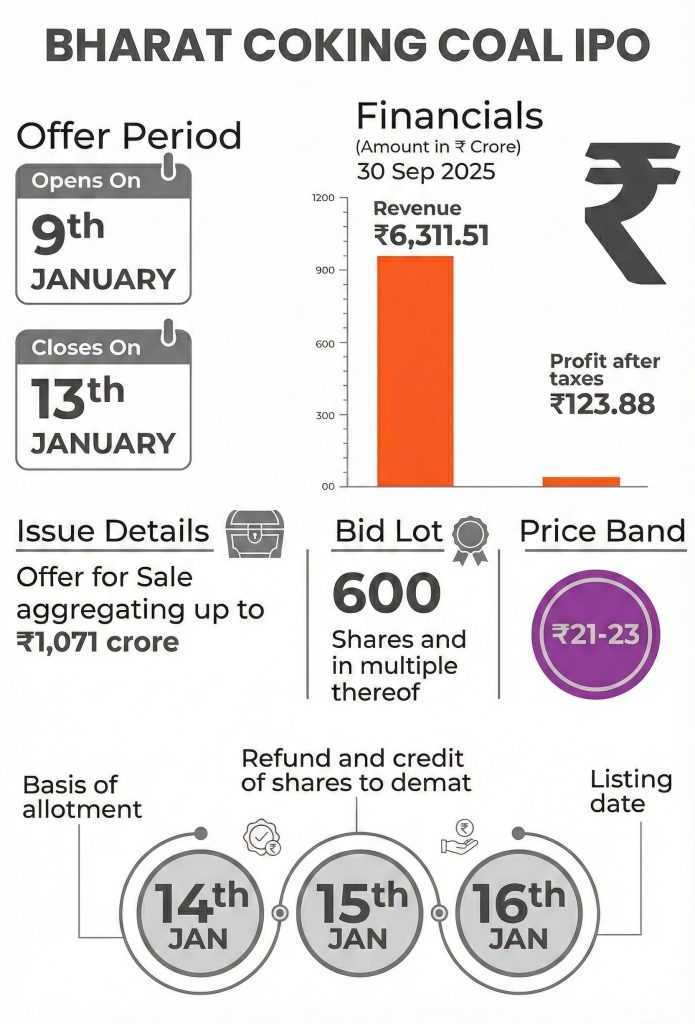

Mumbai: The initial public offering of Bharat Coking Coal Ltd. opened for subscription on January 9, 2026, and will close on January 13, 2026. This leaves investors with just one day remaining to apply for the mainboard public issue. The subsidiary of Indian PSU Coal India Ltd has fixed the Bharat Coking Coal IPO price band at ₹21 to ₹23 per equity share. The energy PSU aims to mobilize ₹1,071 crore through the Offer for Sale route. The OFS issue is proposed for listing on the BSE and the NSE.

BHARAT COKING COAL IPO GMP TODAY

Bharat Coking Coal shares have staged a recovery in the grey market after declining over the last two sessions. According to market observers, Bharat Coking Coal shares are available at a premium of ₹11 in the grey market today. This means Bharat Coking Coal IPO Grey Market Premium today stands at ₹11. Market observers attributed the rise in Bharat Coking Coal’s IPO GMP to an improvement in secondary market sentiment. They suggested that the rebound in the Indian stock market and the strong investor response to the public issue could be the possible reasons for the trend reversal in the grey market sentiment regarding the Bharat Coking Coal IPO.

By 11:36 AM on the third day of bidding, the public issue had been booked 52.56 times, the retail portion had been subscribed 35.24 times, whereas the NII segment had been filled 165.21 times. The QIB portion had been subscribed 2.56 times its value.

Read More: Stock Market Today: Nifty50 Opens Above 25,900; Sensex Gains Over 140 Points

BHARAT COKING COAL IPO REVIEW

Anand Rathi has assigned a subscribe tag to the public issue, saying, “Bharat Coking Coal, with a strong market share in the industry valued at ~8.64x P/E on FY25 earnings (at the upper band), is valued fairly. Considering the company’s consistent track record & superior financial metrics, the valuation is fully priced in. Hence, we recommend subscribing to the IPO for listing gains.”

Marwadi Shares and Finance also assigned a buy tag to the public issue, saying, “Considering the TTM Sep-25 EPS of ₹1.32 on a post issue basis, the company is set to list at a P/E of ~17x with a market cap of ₹10,711 Cr. There are no Indian listed industry peers of comparable size and a similar line of business to the Company; therefore, it is not possible to provide an industry comparison. We assign a Subscribe rating to this IPO, as the company is the largest coking coal producer in India, with access to large reserves, and a strong parentage of Coal India Limited. Also, it is available at a reasonable valuation considering the growth potential of the company.”

Adroit Financial Services, DRChokesy, Kantilal Chhaganlal Securities, Aditya Birla Money, Axis Capital, Canara Bank Securities, Canara Bank Securities, GEPL Capital, Mehta Equities, Nirmal Bang, Swastika Investmart, and Ventura Securities have also assigned a subscribe tag to the Bharat Coking Coal IPO.

BHARAT COKING COAL IPO DETAILS

The most likely allotment date for the Bharat Coking Coal IPO is 14 January 2026. KFin Technologies has been appointed the official registrar of the book build issue. IDBI Capital Markets Services and ICICI Securities have been appointed lead managers of the public issue. The most likely date for the share listing is 19 January 2026.

Disclaimer: This story is for educational purposes only. The views and recommendations above are those of individual analysts or broking companies, not Mumbai Samachar. We advise investors to check with certified experts before making any investment decisions.