India’s central banking authority has delivered comprehensive updates from its latest Monetary Policy Committee deliberations. The Reserve Bank of India’s governing panel has made substantial adjustments to key lending rates during their June 2025 sessions.

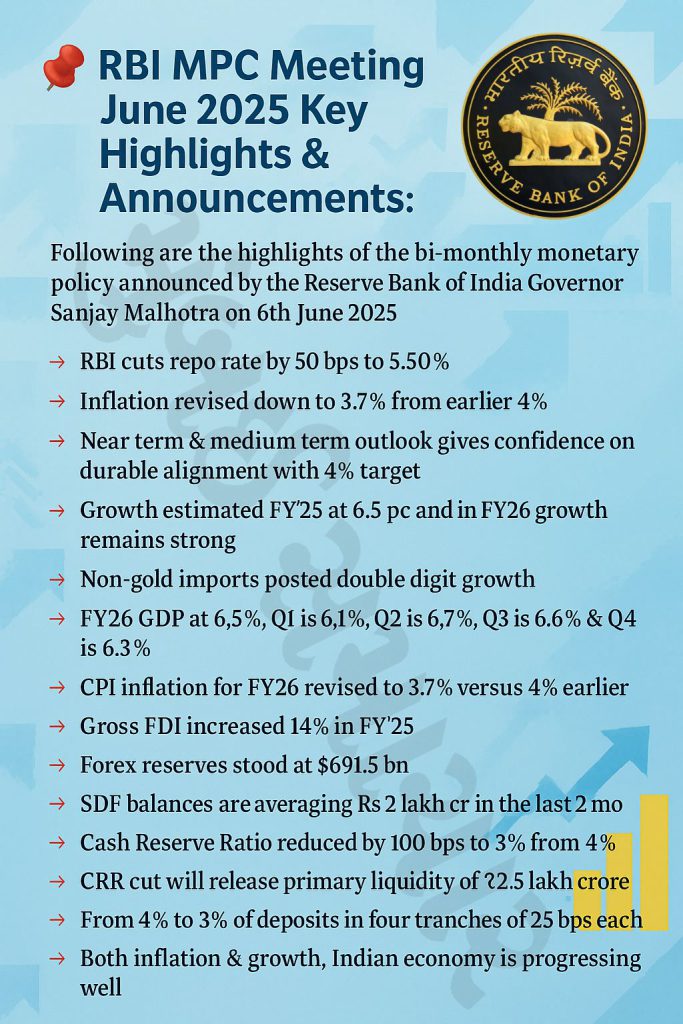

The Monetary Policy Committee concluded its assessment by implementing a substantial 50 basis points reduction to the benchmark lending rate, as announced by RBI Governor Sanjay Malhotra, bringing it to 5.5 percent. This decision represents the third consecutive rate adjustment this year, following previous modifications.

During the previous committee meeting held in April, India’s monetary authority had implemented a 25 basis points adjustment, reducing the primary lending rate from 6.25 percent to 6 percent. Governor Sanjay Malhotra delivered this announcement following a two-day committee session that began on April 7th. This action continued the pattern established in February when a similar 25 basis points reduction was executed.

Market analysts had anticipated another rate adjustment during this committee session, particularly given the significant cooling of consumer price inflation to 3.16 percent in April. Financial institutions, including Union Bank of India, project retail inflation could reach a six-year minimum of 3 percent.

The central bank’s decision comes as inflation has declined below the lower policy band of 4 percent, prompting measures to stimulate economic growth. Additionally, the monetary policy stance has been adjusted to neutral, signaling a balanced approach between controlling inflation and supporting economic expansion.

The following section presents key outcomes from the Reserve Bank of India’s Monetary Policy Committee sessions spanning from April 2025, February 2025, December 2024, October 2024, August 2024, June 2024, and April 2024.